Area Method -

Practicum and Case Study Example

© 2016

Brian Mork, Ph.D. [Rev 2.1]

Home •

Site Index • Wiki • Blog

Introduction

Other web pages document the mechanics, and describe the utility and

appropriateness of the Dual Coverture Value Area Method

(DCV-AM) to divide military retirements in case of divorce. In

short, DCV-AM is an improvement to prior methods that gives the same

results. DCV-AM is easier

for the courts, more lucid, more simple, more

capable. It is capable of equitably dividing retirements

equitably when other methods can not. This document gives

practical steps to

implement AM in your case.

The Area Method discussed

on this page is applicable to

Active

Duty and Reserve

military retirements. If you are intested in Reserve military

specific issues,

please also see another web page about dividing

military reserve retirement pay. Other web pages deal with law and statutes, promotion enhancements,

and Dual

Coverture

(DC) methods.

Intent

Equitable intent must

drive the appropriate methods.

It would be wrong to use insufficient methods and warp the Court's

intent for equity by saying, "But xxx is the formula we use in our state."

That shoe-horns every person into a simplistic view of the world that

may not be equitable. Yet this is what often

happens because attorneys and Courts feel unable to deal with the

complicated government bureacracy and uniqueness of military

situations. DCV-AM solves this problem.

First, determine the intent of both sides of a divorce. The

answer to these questions are

documented in the first four columns of the table below, and then the

division methods that can be used are listed in the right column.

To understand implications of your selection, you must also see the

red/green selection

chart on the Area Method web page. Settling the answer to

these questions needs to be done before wasting anybody's time on

hashing out court order division language.

In all cases tabulated below, both parties receive annual inflation

adjustments and

time value of money while waiting for retirement payment to

start. This is

accomplished via military pay raises when using DCV-AM,

Dual

Coverture (DC), and Single Coverture (SC) fraction methods. In contrast, DFAS

Hypothetical Method (HM) accomplishes this

by giving Federal COLA numbers to the ex-spouse and military pay

raises to the military member. Such a difference could be

inequitable to either

person based on unkown future numbers. There is no advantage to the

HM over DCV-AM and intentional inequity should be avoided.

Set

aside retirement service credit earned before marriage?

|

Set

aside retirement service credit earned after marriage? |

Set aside promotion

enhancements actively earned before marriage?

|

Set aside promotion

enhancements actively earned after marriage? |

Use This Division

Method |

Yes/No

|

Yes/No

|

Yes

|

Yes/No

|

Only DCV-AM can do this.

|

No

|

Yes/No

|

No

|

Yes

|

DCV-AM or DC.

|

No

|

Yes

|

No

|

Yes

|

DCV-AM, DC, or HM.

|

Yes

|

Yes/No

|

No.

Damages ex-spouse

|

Yes

|

DCV-AM or DC.

|

Yes

|

Yes/No

|

No.

Damages ex-spouse

|

No

|

DCV-AM or SC.

|

No

|

Yes

|

No

|

No

|

SC. Inappropriate civilian division method.

|

| No

|

No

|

No

|

No

|

Violates the law in most

states.

|

Area Method Case Study Example

The Area Method is based on creating and using an area diagram.

The end result is a percentage number to send to DFAS. Or, if the

military member is not retired, you'll send the formula to DFAS and

they will plug in numbers known only at retirement in order to

calculate the percentage number at that time. The percentage is

calculated using a numerator and a denomintor. Here's how to

calculate each.

Creating and using the diagram is straightforward. Follow in the

example below. You can also plug the numbers into a spreadsheet that

automates the calculations. Download the Dual

Coverture Value Calculator

spreadsheet from the references

section below.

STEP 1 - Collect the retirement Duty Credit information you will

need

(months or points/30). See the column in the table below.

Collect the Rank, Longevity, and Basepay information you will

need, summarized in the table below. Notice if you're a

Reservist, longevity is your total service years used to look up on a

pay chart, while duty credit is (retirement points/30) as mandated by

the Federally

mandated retirement formula.

Event

|

Date

|

Rank/Grade

|

Longevity

(yr)

|

Basepay

($/mo)+

|

Service

Credit (mo)

|

enlisted

|

4/15/1993

|

n/a

|

0

|

n/a

|

0

|

married

|

4/15/1997

|

O-2

|

4

|

4148.10

|

37.633

|

divorced

|

2/15/2009

|

O-5

|

15.8

|

6853.80

|

210.000

|

retired

|

future*

|

O-5

|

22

|

7928.70

|

266.333

|

*When

the division order is written, grayed future numbers in this row are

impossible to know. DFAS will supply these numbers upon

retirement.

The numbers shown here are guessed numbers, provided only so a complete

case study and

demonstration can be shown before retirement actually happens.

+The exact year used to look up base pay doesn't

matter because only pay ratios

matter. Year to year, although the numbers will change, the

ratios do

not. In this example, 2009 was chosen because that's when

litigation

occured.

|

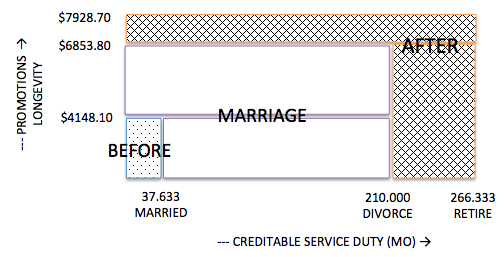

STEP 2 - Draw the area diagram. Drawing the diagram is optional,

but it really

helps visualize things. The white area is marital property and

will be divided. The hashed and dotted areas are belong solely to

the

military member because they were actively earned without any

contribution by the ex-spouse.

- On the horizontal axes, write down the amount of duty

accrued at each transition of life (marriage, divorce, retirements) out

to 3 decimal places. Active Duty use months; Reservists use

points/30.

- For the vertical axes, look up military monthly base pay at

each transition of life. It is

important to use the same year paychart for all lookups even though the

events occured at different years. It is often convenient to use the

year of divorce since that’s when

everybody is looking at the issue.

STEP 3 - Write down how to calculate the marriage

portion of the diagram,

by looking at the diagram. All the numbers should be

known,

because this will be based only on present day or history. This will be

the coverture fraction numerator. In the formula below, D is the

duty

at marriage

or divorce (according to the subscript), and V is the value of a year

at marriage or divorce (according to the

subscript).

Numerator = ( DDVD

- DMVM

) (big white square minus the dotted area in the lower left)

Numerator = (210 * 6853.80 - 37.633 * 4148.10)

Numerator = 1283191

STEP 4 - Write down how to calculate the total

area of the diagram. This may contain numbers you don’t know yet

such as

total

retirement points. This will be the coverture fraction

denominator. In the formula below, DR is

the duty at retirement, and VR is the value of a year at

retirement. If you are not yet retired, you cannot provide the

numbers - rather you have to leave the retirement numbers unspecified

in

the order and tell DFAS to put them in later.

Denominator = DRVR

Denomintor = (263.333 * 7928.70)

Denominator= 2111677

STEP 5 - Write down the words to divide the numerator by the

denominator.

You will get a fraction 0.0 to 1.0, which is the coverture

fraction.

Coverture Fraction = 1283191 / 2111677

Coverture Fraction = 0.607665

The ex-spouse typically receives a portion equal to 1/2 of the

coverture fraction, or

30.38% of the retirement monthly paycheck in this case,

STEP 6 - The division order language will be 50% times the coverture

fraction times the monthly disposable retirement pay. Something

other than 50% may be used if the marital asset is not

divided equally.

The legal language to implement the Dual Coverture Value or Area Method

is given here. This is

the textual equivalent of the steps above, telling DFAS how to do the

coverture

fraction. If retirement has not happend, this paragraph is the

only part that goes to DFAS. If retirement has happened, just

send DFAS the percentage.

“The former spouse is awarded a

percentage of the member’s disposable military retired pay each month,

to be

computed by multiplying 50%

times a Coverture Fraction. The Coverture Fraction numerator is 1283191.

The Coverture

Fraction denominator is member’s total number of retirement duty months

times basepay at time of retirement. Basepay values

for this formula will be looked up on the 2009

year pay chart. If a Reserve retirement is obtained, duty months =

points/30."

Notice that the charted base pay at time of retirement is used in the

coverture fraction even though it may not be used to calculate actual

retired pay. To calculate retired pay, "High-3" base pay might be

used, or maybe a 1% reduced base pay, or other numbers based on future

law. It doesn't matter. For the formula to work, we need

actual charted base pay because we care only about the ratio of pay

values on the chart.

STEP 7 - Remember, nobody knows the exact point count or pay grade

when the

military

member will in the future retire. The only numbers DFAS will

provide later are the retirement values. The court division order

must

provide all the other numbers as shown in the quoted texts above.

To finish this example, the 2009 paychart shows the retirement pay

would be $4399.33 in 2009

dollars. The

coverture fraction would be 60.77%, so the marital asset is $2673.32

per month, and each spouse gets half. The spousal fraction

calculated by DFAS would be

30.38%, or $1336.66 per month in 2009 dollars. Notice the

ex-spouse amount includes the time value of money between divorce and

retirement. Both will

continue to get annual raises as the pay chart goes up each year.

Consider More than Monthly Amount

Selecting the proper method from the table above will correctly divide

the monthly retirement paycheck for Active Duty military and Reserve

military. For

Reserve

military, there is also a question of which paychecks are to be

divided. The value of the retirement asset includes attention to

dividing which checks in

addition to

dividing each check.

Besides dividing each monthly payment, don't forget if you are working

with a Reserve

retirement

with duty spanning 28 January 2008, some or all of the

monthly retirement payments before military member age 60 may not be marital assets. See the 3-D

Value section of the document "Attorney Instructions - Division

of Reserve and Active Duty Military

Retirements" from the references below, and

the web page

"Attorney Guide Dividing Military Reserve Pay".

Traditionally, Reserve military retirement checks start when the

military member turns

60 years

of age because that's when a Reserve retirement begins to pay

out. However, 10 USC 12731(f)(2)(A) created a new and

quantifiably separate retirement for Reservists that does not comingle

in any way with the traditional retirement, and is created and is

accrued only based on military duty after January 28, 2008. If

the ex-spouse did

not participate in earning the new benefit after that date, then the

additional checks earned after the marriage are not part of the marital

asset. For more detailed

reading, see the Reservist

retirement division web page

or the bottom of the Area Method web

page.

- Mork white paper: "A Better

Method to Equitably Divide Military Retirements Upon Divorce", 2016.

- Excel spreadsheet for doing Dual Coverture Area Method, 2016.

- Mork white paper: "Attorney

Instructions - Division of Reserve

and Active Duty Military Retirements", 2011.

- 10 USC 1408 Uniformed Services Former Spouses' Protection Act (house.gov, local copy)

- DOD

7000.14-R Vol 7B "Military Pay Policy - Retired Pay" Chapter 29.

Regulatory guidance replaces DFAS attorney guides as of September 2015.

(defense.gov, local

copy).

- DFAS "Guidance on Dividing Military Retired

Pay", March 2014, 25 pdf pages

with bad formatting, 121 KB pdf. (DFAS.mil, archive copy).

- Older copy April 2012, 20 pgs, 119

KB pdf. (DFAS.mil, local

archive copy).

- Older copy "Attorney

Instructions - Dividing

Military Retired Pay", April 2001,

19 pgs, 74kb pdf. (DFAS.mil, local archive

copy).

- DoD Report to Committees on Armed Services of the US Senate and

House of Representatives, 1998? 2002? (Defense.gov, local

copy) (84

pgs, 279kb pdf)

- Dual

Coverture Does Simple Division Orders--reply

to William Troyan.

- Letter to DFAS

recommending Area Method (Dual Coverture Method) replace the

Hypothetical Method in their published guidance.

- Excel spreadsheet showing that Dual Coverture and Area Method gives the same

results as Hypothetical.

This document was

edited using Kompozer. © 2016

Brian Mork, Ph.D.