Tutorial on the

2017 National Defense Authorization Act and USFSPA

© 2017

Brian Mork, Ph.D. [Rev 1.35]

Home •

Site Index • Wiki • Blog

Introduction

This page is a tutorial on dividing military retired pay in divorce

cases when the military person may be

promoted before the marriage or after the divorce. Over the past

decade or more, states have moved toward standardizing on a certain way

to divide the pension. This web page introduces what became law in 2017 and how to actually implement it in court.

[ Update Jan 2018. Text here are

mathematically correct. However, procedurally, DFAS advises that

the only order text they will accept under the new law is the

Hypothetical Method. See https://www.facebook.com/military.divorce.retirement.division/posts/897907877049819 ]

Demonstrating equity, the new law could

increase

payments to either of the spouses. Military retirements are a

significant benefit, earned by both women

and men. As of March 2011, there were more

than twice as many military women divorcing

than men. Among enlisted, the military women divorce rate is

about 3x that of men. The overall military divorce rate in 2011

is

64%

higher

than it was in 2001. Dollar value of a military retirement in 2012

dollars range from $945,000 for an E-7 to

$2,800,000 for an O-8. Military

divorce is a significant social

issue

affecting both sexes.

If you are an attorney, it is incumbent on you to respresent the

interests of your client. Being uninformed may set you up for a

malpractice suite. Any military client will understand issues of honest and integrity. For ethical and professional

reasons, the family law community of attorneys and courts should be

interested in getting this right.

A sister web page about dividing military

promotion enhancements earned after divorce

has been published for years. The two issues are almost the

same. A super-concise

slide show

is also available. The sister web page discusses with more detail

how objective parties have weighed in on and agree that retirement

enhancements due to promotion outside of marriage are not a marital

asset and are not comingled. Six examples:

- A 2001 United States Armed

Services Committee report to Congress.

- In 2005, the Florida

Third District Appellate Court reversed

(case 3D04-1468).

- In 2009, a Michigan

Appellate Court reversal.

- On 5 May 2012, a new Oklahoma

law

SB1951 Section 3(F).

- On 28 October 2013 the Pennsylvania House Democratic Committee

held hearings on HB1192.

New Law

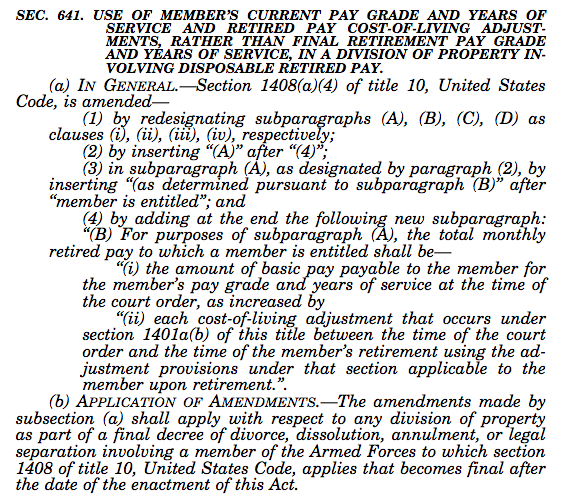

Spring of 2016, for the Fiscal year 2017 National Defense Authorization

Act (NDAA), U.S. Representative Steve Russel (R-OK) introduced an

amendment to adjust the USFSPA. This update was recommended by

the September 2001 Department of Defense report to the Armed Service

Committees.

The proposal was unanimously accepted by the bi-partisan Armed

Services Committees. The Senate

version (S. 2943 Sec. 641) said,

"In

calculating the total monthly retired pay to which a member is entitled

for purposes of subparagraph (A), the following shall be used:

(i)

The memberís pay grade and years of service at the time of the

court order.

(ii) The amount of pay that is

payable at the time of the memberís

retirement to a member in the memberís pay grade and years of service

as fixed pursuant to clause (i)."

While the House bill (H.R. 4909 Sec. 625) said,

“[member

entitlement] is to be determined using the member’s pay grade and years

of service at the time of the court order, rather than the member’s pay

grade and years of service at the time of retirement, unless the same’’

The legislative reconciliation process yielded the final bill as shown here.

In many states, case law affirms that the marital asset is not to

be

affected by earning effort outside the bounds of the marriage. In

Michigan, see the

1988 Kilbride Appellate decision, which was quoted, re-affirmed, and

extended in

the 2009 Skelly Appellate court decision. Notice Skelly abrogates

Reeves 1997, Boonstra 1995, Rogner 1989, Booth 1992, McMichael 1996and

MI SC Bachran 2003 decisions. The Kilibride 1998, Kurz 1989, and

Lesko 1990 lineage succeeds un-challenge for POST-divorce

accruals. Every counter-case is for PRE-marriage accruals or

strives to clarify a Judgement of Divorce that doesn't even attempt to

set aside non-marital accruals. Also, Cunningham's 2015 critique

of Skelly applies only to investment awards like stock options not yet

vested which is totally unlike a military situation totally earning the

benefit and being awarded the benefit after divorce.

The part of Kilbridge I am basing discussion on has not been challenged

and Skelly makes an even stronger case. Many other states have

similar case law as Kelly. Although mathematically Kilbride arrived at

a single

coverture fraction, that is because there was no promotion affecting

that case. To cite it supporting a single coverture fraction in

the face of a post-divorce promotion is to ignore the foundational

argument made by the appellate court that the marital asset must be

preserved and limited to what was earned during the marriage (expressed

in constant year dollars, both parties get COLA). The Kilbride

decision lays out a litmus test that the marital retirement asset must be defined so

that whatever either party does after the divorce cannot make it go up

or down. Quoting from Kilbride,

"...the

portion of a pension attributable to service credit earned before the

marriage or after the divorce is not distributable as part of the

marital estate."

"The decisions of the parties

following the judgment of divorce must not affect the value of the

distribution of a portion of the pension to the nonemployee spouse."

This is not talking about COLA increases, which both members passively

receive for all time after the divorce, although states like

Indiana withhold COLA from division also because it is not yet earned

at time of divorce. Because there were no promotions in Kilbride, a

single coverture fraction worked fine. However, the new law

duplicates that calculation and also creates equity where there is a

promotion outside the bounds of the marriage, consistent with the

foundational argument and litmus test of Kilbride.

Mathematically, the inequitable time-only coverture method used by some courts has been:

marital

asset = DRP ∗ (marital duty time

/ total duty time)

where "DRP" means "disposable retired pay", which is exactly defined

in USFSPA. After applying this formula, typically 50% of the marital

asset is awarded to each party.

The

new law changes the definition of DRP in 10 USC 1408(a)(4), which is

implemented by using an additional coverture fraction of

monthly pay from standard military pay tables. Because the ratio

is the important factor (not the

two dollar amounts, per se, that make up the fraction), it’s important

to note that the two

monthly pay amounts at the two different ranks are taken off the same

year’s pay chart – do not take one from the year of divorce and one

from the year of retirement. The new method uses a new DRP.

This new DRP can then used with a time-based-only coverture because the 2nd fraction is built into the definition of DRP.

DRP_new = DRP_old * (pay at divorce / pay at

retirement)

The “pay at divorce” is the new thing fixed by paragraph (ii) of the

law quoted above. The result

is a DFAS

percentage method that is not a DFAS fixed method.

marital

asset = DRP_new ∗ (marital duty time

/ total duty time)

Or, to better compare this to the old formula, you can do the same new calculation this way:

marital

asset = DRP_old ∗ (marital duty time

/ total duty time) ∗ (pay at divorce / pay at

retirement)

Writing the formula fractions out long hand shows this IS the Dual Coverture (DC) method I've advocated for the past six years. If all the mathematics confuses you, see the slide show summary of the new method for visual aids.

I've received some push back against the new law, asking for case

law examples that support the new law. This seems to ignore that correcting bad case law is

the precise purpose of a new statutory law.

For example, the USFSPA came about in response to a U.S. Supreme Court

decision. The main point I'm trying to make

is about education: if others teach factual errors and write white

papers with gloom-n-doom conclusions based on false assertions and inuendoes, this provides a

tremendous disservice to attorneys and legislators and judges trying to

get their heads around these issues.

Please, review the material published on these web pags and let me know

where it's faulty. There is a concise slide show presentation on

this topic that can be used for training or continuing professional

education. If an interactive conversation will help,

please give me a call or email!

Examples

As an example, if a disposable retirement check was $3298 in 2016 dollars,

and 4700 duty points were accrued during the marriage and 5500 duty

points were accrued during the entire military career, a simple

time-based coverture fraction would determine that the marital

asset would be

marital asset = $3298 *(4700 / 5000) => $2818.29

The marital asset is not a fixed dollar amount because both parties

receive cost of living increases proportional to the military pay table

cost of living increases each year.

Also, the marital asset is not a pre-fixed percentage determined at time of

divorce because the fraction is not possible to calculate until

retirement is reached. For example, if no military duty is done

after the marriage, the ex-spouse would get 50% of the total

retirement. However, if post-divorce duty is done, the time-based

or duty-based coverture fraction allows one to break out the unchanged

marital asset from a retirement check and the spousal award will be

less than 50% of the bigger retirement check. The traditional single

coverture solution is a mathematical precise and exact calculation

designed to keep the divisible marital asset the same, not to dilute it

in any way. Again, to forestall confusion, we’re not talking about COLA increase which happen

for both parties each year and accrues even during the years before

retirement pay starts.

Okay, so a single coverture fraction works fine if there are no

promotions, and DC/NDAA 2017 retain this featuer because the 2nd fraction will be 1.0 or 100%.

However, if promotion happens outside the marriage,

inequity happens with the old formula. For example, if the disposable

retirement check at higher rank was $5000 in 2016 dollars, and

everything else stays the same, the old formula would calculate a

marital asset of $5000 * (4700/5500), or $4272.72 in 2016

dollars. This is a 51.6% inequitable windfall to the ex-spouse

even though they had nothing to do with the promotion and contributed

nothing after the divorce!

Now, see that the new NDAA law restores the marital asset to what it

should be. Since DFAS will be responsible for implementing the

new definition of DRP, you can use the same time-base coverture

fraction formula as shown above.

DRP_new = $5000 * ($3298 / $5000) => $3298 (DFAS does this)

marital asset = $3298 *(4700 / 5000) => $2818.29 (Division order does this)

Notice the new law makes the DRP at the time of retirement become what the DRP was back at the

time of divorce. In other words, the litmus test is satisfied

that the marital retirement asset must be defined so

that whatever either party does after the divorce cannot make it go up

or down.

For division orders formalized after 23 Dec 2016, you'll use the new

definition of DRP (implicitly including one fraction) and have only the

2nd time coverture fraction explicitly named. If you want to

mimic the

result while using the old definition of DRP (division orders

formalized 23 Dec 2016 and before - or orders that DFAS will not

calculate or pay), just spell out the second coverture fraction in the

division order:

marital asset = $5000 * (4700 / 5000) * ($3298 / $5000) => $2818.29

Notice

the

marital asset is exactly and precisely preserved, down to the

penny.

These results are all in 2016 dollars, and the marital asset goes up

proportional to military pay charts each year, and both parties benefit

from this same COLA bump-up.

If the text numbers are confusing to you and you'd rather see examples

presented with visual diagrams, please see the NDAA white paper showing

how the NDAA amendment (Dual Coverture method) affects the two spouses.

Correcting Bad Counsel on the Street - Falicy of "Based On" and

others

Some people say the promotion enhancement (move from $3298 to $5000 is “based on” early marital

work and therefore it IS a marital asset even though it occurs from

active effort outside the marriage. Do not confuse passive

enhancements such as interest in a bank account that cannot be

dispersed yet. Here we are talking about competitive,

effort-based earning activity that was done by only one party after the

divorce - plus the fact that the benefit doesn't fully vest for 3 years

after a promotion. The phrase “based on” is used by some to tap

an intentionally undefined phrase that is confusing and

manipulates court understanding one way or the other. In this

context “calculated from” is much more precise and legally meaningful.

In other contexts, try using "earned during" or "accrued during" --

which is probably what the divorce order says.

Much more is written critiquing the phrase “based on” in other papers

in the sister web page. For now, look at the divorce decree award

language and realize that the standard threshold for a marital asset

includes the phrase “earned during” or “accrued during”, not “based

on”. Two quick case studies: if after divorce an ex-spouse writes

a book “based on” the military marriage, are proceeds divided?

No. If a military pilot gets a commercial flight job after divorce

“based on” their military training and flight hours, is the civilian

retirement divided? No.

The other way I’ve seen the inequitable 51.6% windfall perverted is

citing a legal precedence awarding passively earned interest

after divorce as a marital asset, as using this as an argument to

divide actively

earned enhancements. Not the same! In Michigan, the 2009 Skelly

Appellate court clarified that even an asset already received

during marriage

is not a marital asset if additional post-divorce work

is required to keep it. By the way, this portends that Michigan

case law may be evolving toward no division of any

military retirement which requires more duty to secure it.

In any case, by implementing the Dual Coverture method or Hypothetical

Method, Congress has decided the "base on" argument is false.

Four specific confusions endure from material published in an

American Bar Association white paper signed in August 2016:

- The NDAA requirement indicates a DFAS percentage based method, as

shown on this web page and other documentation from increa.com web

pages. The NDAA is not a fixed benefit division and does not

fit the definition of a DFAS fixed-based method. This has BIG

implications.

- COLA is automatically awarded equally to both parties,

using the

increases in military pay charts each year. The white paper

comes to an opposite conclusion. This may be because COLA is done

in a confusing way by the DFAS Hypothetical Method. In contrast,

the new NDAA

law uses equitable, equal, and automatic COLA for both parties!

- Avoid the promulgated falsehood that there are 4 DFAS acceptable

division methods. This confusion may come from the fact that DFAS'

Attorney Instructions gives 4 examples.

There

are only two acceptable DFAS types of division (nothing else) and they

are exclusive (cannot be both at the same time). See Under

Secretary of Defense Regulation DOD 7000.14-R vol 7B Chapter 29 Para

2906-01.C (page 29-12). In addition to clear statement in DOD

Regulation, a 2005 USFSPA Army

JAG tutorial makes this clear on page 11, paragraph IV.C.1.

In paragraph IV.C.2, the four DFAS examples are discussed and the

document "Attorney Instructions for Dividing Retired Pay and Sample

Court Order" is introduced. As of mid-2016, the Chief legal

counsel at DFAS explained that the Attorney Guide has been pulled from

circulation and requests are being directed to the foundational

regulation 7000.14-R behind it.

- The ABA takes a position that the Federal government has no

business invading into State divorce law ...while simultaneously

supporting the 1982 USFSPA law, which is the most invasive divorce law

on the books. It would be consistent to support Federal

intervention or not, but not

both sides of the issue.

Division Order Text

[ Update Jan 2018. Text here are

mathematically correct. However, procedurally, DFAS advises that

the only order text they will accept under the new law is the

Hypothetical Method. See https://www.facebook.com/military.divorce.retirement.division/posts/897907877049819 ]

Using the new definition of DRP requires no special call-out in the

division order. After the law's date of enactment, it will happen

automatically when DFAS does the payment. Here is the actual text

you can put into a client's division order. The bolded numbers

must be customized.

"The

former spouse is awarded a percentage of the member’s disposable

military retired pay, to be computed by multiplying 50% times a

fractions, the numerator of which is 168 mo, and the denominator of which is the total number of months of retirement

creditable service. If a Reserve retirement is

obtained, months = points/30.”

For division orders prior to the law's date of enactment or for orders

that will not be paid out by DFAS, here is the actual text you can put

into a client's division

order to mimic the behavior of the new law. The bolded numbers

must be customized. If you want

to know how to do that, see the sister web page.

Sample language for a court order is available from the sister page.

Reproduced here:

"The

former spouse is awarded a percentage of the member’s military retired pay, to be computed by multiplying 50% times two

fractions, the first numerator of which is 168 mo, and the first

denominator of which is the total number of months of retirement

creditable service, and the second numerator is the base pay of a 14

year O-4 rank, and the second denominator is the base pay of the

member

years and rank upon retirement. Both base pay amounts are to be

taken from the 2009 year

military chart. If a Reserve retirement is

obtained, months = points/30.”

--- OR --- (combine two numerators ahead of time as shown in Area Method Practicum)

“The

former spouse is awarded a percentage of the member’s military retired pay each month, to be computed by multiplying 50%

times a Coverture Fraction. The Coverture Fraction numerator is

1283191. The Coverture

Fraction denominator is member’s total

number of retirement duty months times basepay at time of

retirement. Basepay values for this formula will be looked up on

the 2009 year pay chart. If a

Reserve retirement is obtained, months = points/30."

For division orders that include duty time before marriage or more than

one marriage, a Dual Coverture method may be insufficient and you'll

need to use the complete Area Method.

Conclusion

- The new law is a DFAS percentage method that is not a DFAS fixed

dollar method.

- In

cases where promotions happen after divorce, equity (as

defined by the Kilbride litmus test) is accomplished by a changed

definition of disposable retired pay, or by using a second coverture

fraction with the old definition of disposable retired pay.

- The new law is simple to implement and has none of the "doom and gloom" implications claimed by

some.

Additional engagement opportunities:

- Slideshow

primer of 2017 NDAA and USFSPA.

- DFAS instructions on what to submit under the new law.

- "Sample Order Language 2.pdf" published by DFAS (local copy).

- DoD Report to Committee on Armed Services of the US Senate and

House of Representatives, 2001. (Defense.gov,

increa

copy) (84

pgs, 279kb pdf)

- Sullivan's Aug 2016 white paper gainst the 2017 NDAA amendment (americanbar.org,

local

copy).

- Rebuttal to Mark Sullivan's Aug 2016 hit piece against NDAA 2017.

- Rebuttal to Marshall Willick's piece against NDAA 2017.

- Rebuttal to Mark Sullivan's Feb 2017 hit piece against NDAA 2017.

- Demonstration

of the 2017 NDAA law division formula.

- NDAA amendment to

USFSPA can help either spouse.

- PRE-NDAA2017 Excel spreadsheet for doing Dual

Coverture Value (Area Method) Calculations, September

2012. Includes court order legal language.

- POST-NDAA2017 Excel spreadsheet for doing Dual

Coverture Value (Area Method) Calculator, March 2017. Includes court order legal language.

The

shell of this document was created

using AbiWord

under the Linux

Gnome

desktop. Content was edited using Kompozer.

© 2017

Brian Mork.